WHAT NONPROFITS NEED TO KNOW ABOUT THE NEW TAX LAW

The number of taxpayers who itemize deductions on their federal tax return — and, thus, are eligible to deduct charitable contributions — is estimated by the Tax Policy Center to drop from 37% in 2017 to 16% in 2018. That’s because the recently...

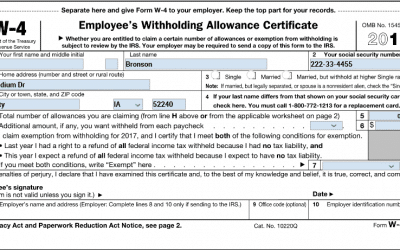

Pay Attention When You Get Paid

Over the past couple of months, it has been hard to avoid the noise coinciding with what is formally known as the Tax Cuts & Jobs Act. Now that the bill has passed, and much of that noise has become a reality, the consequences of the reform are impossible to...

Business New Year’s Resolutions

Every year, as we turn the calendar from one from one year to the next, many of us contemplate self-imposed resolutions as a means of improvement. We interpret the dawn of a new year as if it were a clean slate; as we compartmentalize years into chapters, January...

Tax Cuts & Jobs Act Is Good For Business

As I write this article, Congress is about to vote on major corporate tax reform, namely the “Tax Cuts and Jobs Act”. Supporters of the bill believe that corporate tax reform will more readily allow US corporations to keep taxable earnings in the US and that those...

Time is running out to make your state income tax payments and still be provided a deduction on your Federal income tax return.

Unless you have been hiding under a rock, you are aware that both the House and Senate have passed legislation to update the tax code. Both plans are calling for a repeal of the deduction for state and local income tax expense. Although we are not yet sure of the...

How Can Life or Career Changes Affect Your Tax Return?

Have you recently changed jobs? Started your own business? Maybe welcomed a child to your family? Well, all of these situations could have tax consequences or benefits, requiring some financial planning. When changing jobs, there are several things to consider. Did...